Springfield, IL (CAPITOL NEWS ILLINOIS) – Gov. JB Pritzker is asking state lawmakers for more authority to regulate the homeowners insurance market in Illinois.

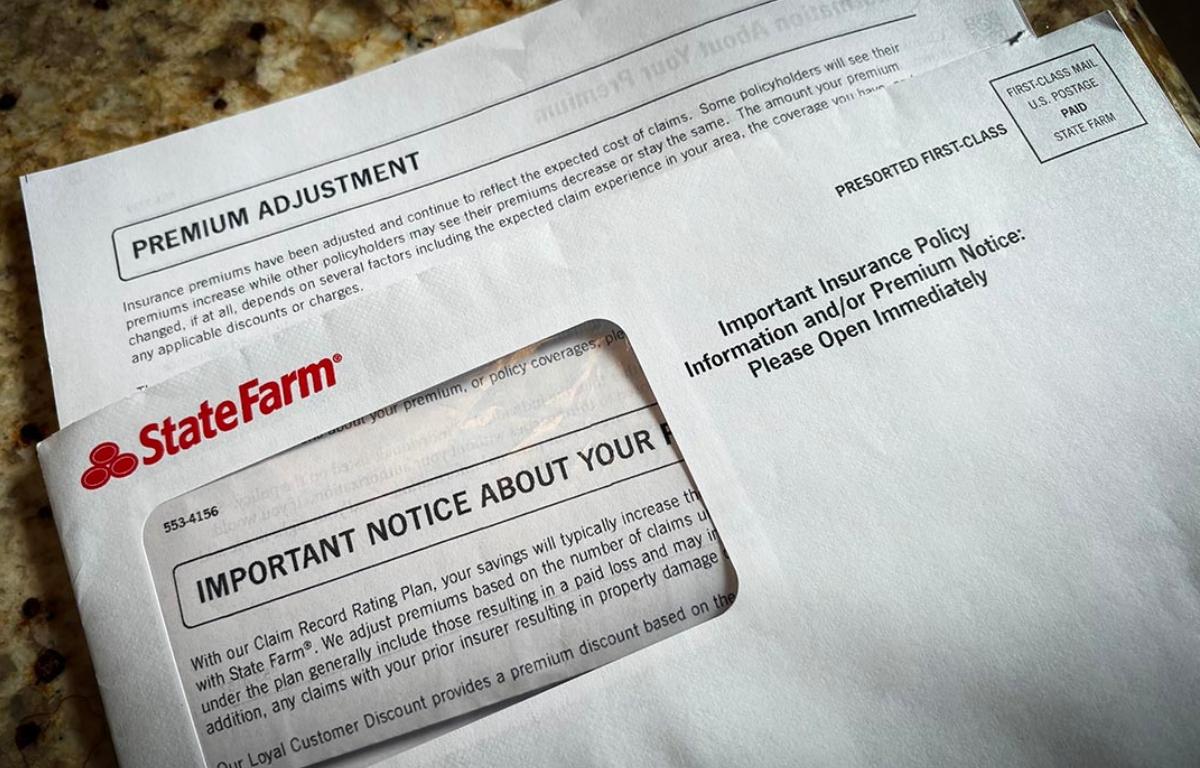

In a statement July 10, Pritzker called on lawmakers to pass legislation in the upcoming fall veto session, “that prevents insurance companies from taking advantage of consumers through severe and unnecessary rate hikes like those proposed by State Farm.”

The veto session is scheduled to begin Oct. 14.

“Over the past six years, our state economy has flourished based on transparent markets and fair competition,” Pritzker said. “State Farm’s actions are antithetical to the core principles that the Illinois business community is built on.”

The higher rates took effect July 15 for new policies and will go into effect Aug. 15 for renewals of existing policies.

Current regulations

Although Pritzker was not specific about what kind of increased regulatory authority he wants lawmakers to consider, some consumer advocates have called for giving the state Department of Insurance broad authority to review, modify or even reject proposed rate hikes.

Under current state law, companies are required to file their rates with the Department of Insurance, and the agency can review consumer complaints to determine whether the rates being charged are consistent with those filings.

But currently, according to the agency, Illinois is the only state in the country that does not prohibit rates from being “inadequate, excessive or unfairly discriminatory,” which means it has no authority to reject a rate filing on those grounds.

Douglas Heller, director of insurance for the Washington-based Consumer Federation of America, described Illinois’ law as “among the most toothless in the nation.”

In April, CFA issued a report that said from 2021 to 2024, Illinois ranked second in the nation for having the greatest increases in homeowners insurance premiums. Average premiums in Illinois rose 50% over that period, more than any other state except Utah, where rates went up 59%.

“At a minimum, Illinois should empower the Department of Insurance to reject or modify excessive rate hikes, which would represent a basic consumer protection that residents in almost every other state enjoy,” Abe Scarr, director of the Illinois Public Interest Research Group, said in a statement in response to the report.

In recent years, lawmakers have given the Department of Insurance broader authority to regulate premiums in the health insurance market.

Last year, Pritzker signed legislation giving the agency authority to review and reject proposed rate increases in large-group health insurance plans. That law also prohibited companies from engaging in certain “utilization management” practices that steer patients toward cheaper therapies and medications to lower payouts.to lower payouts.

But the agency does not yet have that kind of regulatory authority over property casualty insurance policies for homeowners, renters and condominium owners, a fact that consumer advocates say puts Illinois out of step with the rest of the nation.

Reasons for rate hikes

In his statement, Pritzker accused State Farm of raising rates in Illinois to cover losses the company has suffered in other high-risk states like Florida.

But State Farm strongly denied that suggestion, saying the increases were directly related to the cost of weather-related disasters in Illinois.

“For example, last year in the state of Illinois alone, we paid out more than $638 million in hail damage claims,” State Farm spokeswoman Gina Morss-Fischer said in an interview. “That was just in Illinois, and it was second only to the state of Texas. And this is the kind of thing that we’ve started to see more frequently.